An Odometer Disclosure Statement is a legal mandatory form. You have to include the current odometer mileage reading on the state-approved Odometer Disclosure Statement form. This form is necessary when you transfer, sell or buy a motor vehicle model year 2011 or newer and below 16,000 pounds. Usually you can take the reading on the the vehicle’s title or on a separate form, it depends on your state’s requirements. To see more details please read below.

Below you will find all the details and specific legal requirements for each US state. For your convenience we manually verified and reviewed all the forms. So if you’re in a hurry you can use now this Federal Odometer Disclosure Statement. This form is useful as an additional document or when your state doesn’t provide a specific form.

So this legal form provides an exact reading of the mileage currently displayed on the odometer (mileage counter) of the vehicle. You must take this reading at the moment of the vehicle’s transaction or ownership transfer. The Odometer Disclosure Statement serves also as a written proof of mileage for the vehicle’s seller and can be useful in future disputes with the buyer.

What Odometer Disclosure Statement Form should I use?

Below you will find all the details about the Odometer Disclosure Statement requirements for each state:

Choose your state to find all the details about the Odometer Disclosure Statement: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming and Washington DC.

If you want to accurately take an odometer reading here you can learn how to read an Odometer.

Please note that a fillable PDF form is NOT sent electronically to a DMV office when it is completed. You need to complete, print, sign and submit the correct form listed here to the appropriate DMV office in your state. To complete this form always use a pen with black or blue ink and not a pencil.

Is an Odometer Disclosure Statement required by law?

The quick answer is Yes! An odometer disclosure statement and/or reading is mandatory by state and federal law for all vehicles of model year 2011 or newer and below 16,000 pounds.

According to the NHTSA (Department of Transportation’s National Highway Traffic Safety Administration), the fleet of vehicles in the US is now older than ever. Because of that NHTSA had to modify the odometer disclosure rules. In this way it addresses the increasing odometer fraud involving older vehicles. As a result, the model year 2011 or newer vehicles will only be exempt from the odometer rules after 20 years. So anyone transferring a vehicle Model Year 2011 or newer has to provide an odometer disclosure to the new owner (on the vehicle’s title and/or on a separate form). Please keep in mind that sellers of model year 2011 vehicles must continue to disclose odometer readings until 2031, for model year 2012 until 2032 and so on.

Usually these type of vehicles don’t require an odometer disclosure:

- A vehicle model year 2010 or older

- A low-speed vehicle (LSV)

- A non-motorized vehicle (like a trailer-type vehicle)

- A moped or a scooter

- A vehicle with a registered gross weight or gross vehicle weight rating above 16,000 pounds. This includes vehicles that have been registered in another states above 16,000 pounds at any time in the past

Be very careful! When you fail to complete or provide a false statement regarding an odometer reading you may be fined and/or imprisoned!

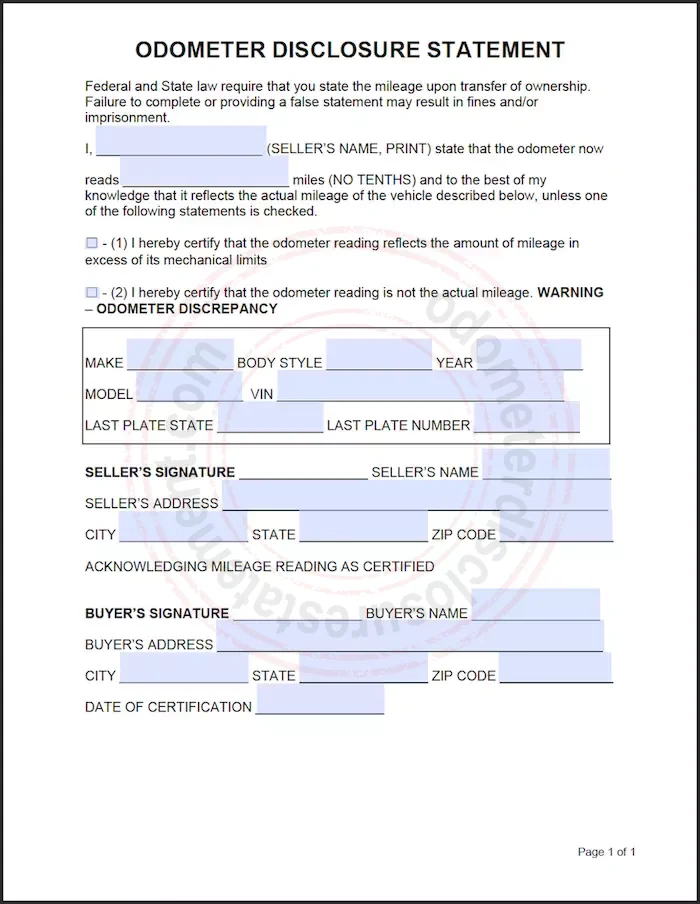

The federal generic Odometer Statement Form

You can also find below a generic federal Odometer Disclosure Statement Form. This form is a fillable PDF that you can complete on the phone, tablet or on the computer. As a recommendation, please complete this generic federal Odometer Disclosure Statement Form in addition to the state required form or title section, for your own records. Remember: each time you sell or buy a vehicle do not forget to complete an Odometer Disclosure Statement!

To be sure you can use a generic federal Odometer Disclosure Statement Form in addition to the specific state required Odometer Statement form.

Here you can download a Generic Federal Odometer Disclosure Statement Form

Legal requirements

The U.S. Department of Transportation’s – National Highway Traffic Safety Administration (NHTSA) amended the federal laws to provide better customer protection. This means that NHTSA keeps accurate records of odometer mileage for a longer period of time. This law is part of the odometer fraud prevention strategy. The duration of the exemption is now 20 years instead of 10 years as a result of this new federal rule.

However, in the past, the requirement to declare the vehicle’s mileage upon sale or transfer did not apply to vehicles that were more than 10 years old. Starting January 1, 2021, you have to declare the vehicle’s mileage in an Odometer Disclosure Statement and/or on the back of the motor vehicle’s title for all vehicles model year 2011 or newer.

As a result, as of January 1, 2021, all eligible vehicles of model year 2011 and newer are subject to odometer disclosure for 20 years. According to the the old rule a model year 2011 vehicle would have become exempt from disclosure in 2021. Now according to the new rule in effect you need to disclose the odometer reading at the sale of a 2011 vehicle until 2031. So the model year 2012 vehicles will become exempt in 2032 and so on…

In the years 1972 and 1976, the US Congress enacted the Motor Vehicle Information and Cost Savings Act (Cost Savings Act). This law aimed to protect buyers of motor vehicles from odometer fraud. Following, in the year 1986, the Congress enacted the Truth in Mileage Act (TIMA), which added provisions to the odometer provisions of the Cost Savings Act.

For how long odometer records are kept?

According to the Federal Register vehicle dealers and distributors and auction companies must keep the records for a certain period. This period is “for five years in a manner and method so they are accessible to NHTSA investigators and other law enforcement personnel.”